Intercompany

Specialized Intercompany Processes

How much accounting time and energy does your company spend on month-end intercompany reconciliation? Are you able to identify intercompany transfer price markups easily across all subsidiaries? Do they reconcile and eliminate automatically? How do you remove inter- and intra-company markups for your global margin analysis?

Modern Multinational Enterprise Structure

Intercompany relationships are typically more complex than single simple transactions from one subsidiary to another. Global enterprises have created intermediary "nodes" or specialized companies for many purposes, such as principal risk taker, customer product and engineering support, repair facility, global purchasing, centralized banking, currency hedging and clearing, and others. These structures can provide great benefits to the global enterprise by reducing duplicate functions and concentrating expertise and risks in a single company. At the same time the challenges for correct and efficient intercompany processing need to be addressed and resolved. Standard intercompany transactions based on product shipment will not suffice for these specialized functions. A repair shipment (consignment) between two subsidiaries, for example, may need very different treatment from a shipment for sale to customers. These differences impact shipping and legal documents, accounting, intercompany pricing, customs clearance, VAT and all other areas. In many cases a single business process involves multiple subsidiaries in financial and legal respects and therefore requires multi-tier intercompany transactions. All related transactions need to be synchronized and correctly reconciled to each other.

ERP Configuration Challenge

Often these complex requirements create a dilemma for global companies and their ERP systems. Companies believe that they have to choose between two very unsatisfactory options. Either they believe they have to continue manual processing (or a very limited automation of G/L journals) or they need to undertake the costly and risky path of extensive customizations of the ERP systems. Most international companies struggle with the challenges of efficient intercompany transaction processing. During daily business activities countless time is spent on entering and processing intercompany transaction, while at every month- and quarter-end all these transactions and balances between the subsidiaries need to be reconciled and eliminated. This process includes complexities such as goods in transit, shipped not billed, goods received not invoiced as well as differences in functional currency fluctuating FX-rates. Lastly, transfer markups and profit-in-inventory in all locations must be identified and eliminated during the consolidation process. Errors in these areas can have very significant impact on the corporate internal and external reporting and may lead to substantial problems when undergoing tax, customs or transfer pricing audits.

Celantra Expert Solutions

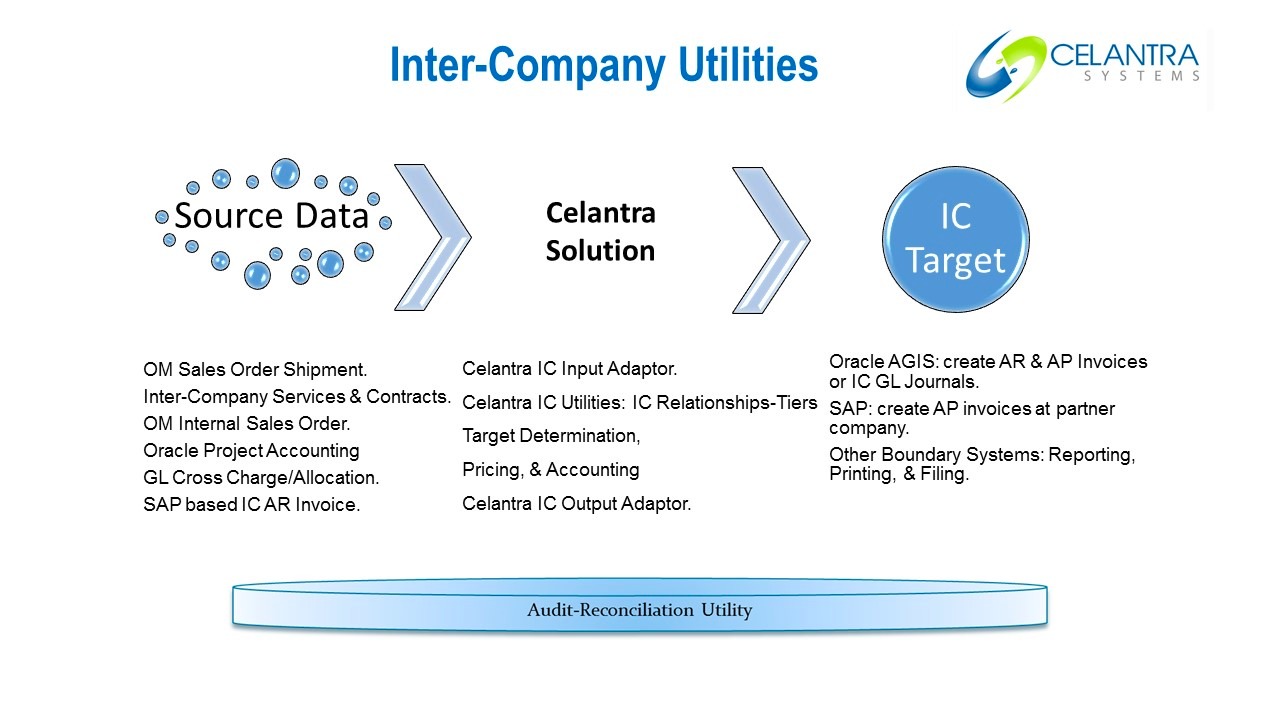

For many years Celantra Systems has helped international companies in the automation of specialized intercompany processes. Our experienced consulting team can quickly evaluate your individual requirements and point you to the most efficient solution. We will also analyze your current business and systems process in order to develop best-practice efficiency. Celantra special intercompany configuration templates and tools can resolve many challenges. In other cases we have proven and tested enhancements to Oracle standard processes readily available. Additionally we will leverage powerful third party tools to resolve more complex requirements.

Specific Challenges For Oracle Intercompany Accounting

Align Trade Cost of Sales to Trade Revenue, Intercompany Cost of Sales to Intercompany Revenue,

Identify intercompany relationship for each I/C revenue and COGS transaction on P/L and balance sheet accounts,

Split intercompany revenue and cost of sales into base cost (Standard cost) and intercompany profit and identify with different accounts, sub-accounts,

Correct accounting for drop-ship transactions and deferred revenue / COGs in intercompany relationship.